Innovating your Business with Green Data Centers

Blog: Innovating your Business with Green Data Centers Data centers are centralized facilities equipped with essential hardware like servers, storage devices, and networking equipment.

The popular mobile wallet app GCash, with 81 million users, recently faced a significant backlash due to over 300 reported unauthorized transactions. This incident profoundly impacted users who discovered that their e-wallets were either empty or had significant amounts missing. After a thorough investigation, it was determined that the issue stemmed from deliberate phishing attempts, rather than hacking or glitches. Cybercriminals took advantage of susceptible users by launching phishing schemes through internet gambling platforms. GCash promptly took action to address the situation and reassure users that no funds were lost. However, frustrations continue to linger among those who trusted the app with their hard-earned money. Despite these concerns, mobile banking and e-wallet applications continue to thrive and remain widely used given their convenience.

In recent years, the Philippines has witnessed a significant shift towards cashless transactions, driven by the “new normal” brought about by the Covid-19 pandemic. The rising popularity of mobile banking and online payments stems from them being alternatives to long queues, physical visits to stores and banks, as well as the need for physical contact when handling cash. These platforms offer 24/7 accessibility, swift transactions, real-time updates on account balances, transaction alerts, and spending analysis, empowering individuals to efficiently manage their finances at the palm of their hand.

However, it is important to recognize the potential security risks associated with mobile banking. Mobile banking can be vulnerable to cyberattacks without proper security measures, putting users at risk of unauthorized access and financial fraud. While such incidents are not common, they serve as reminders of the significance of implementing robust security measures to protect personal and financial information.

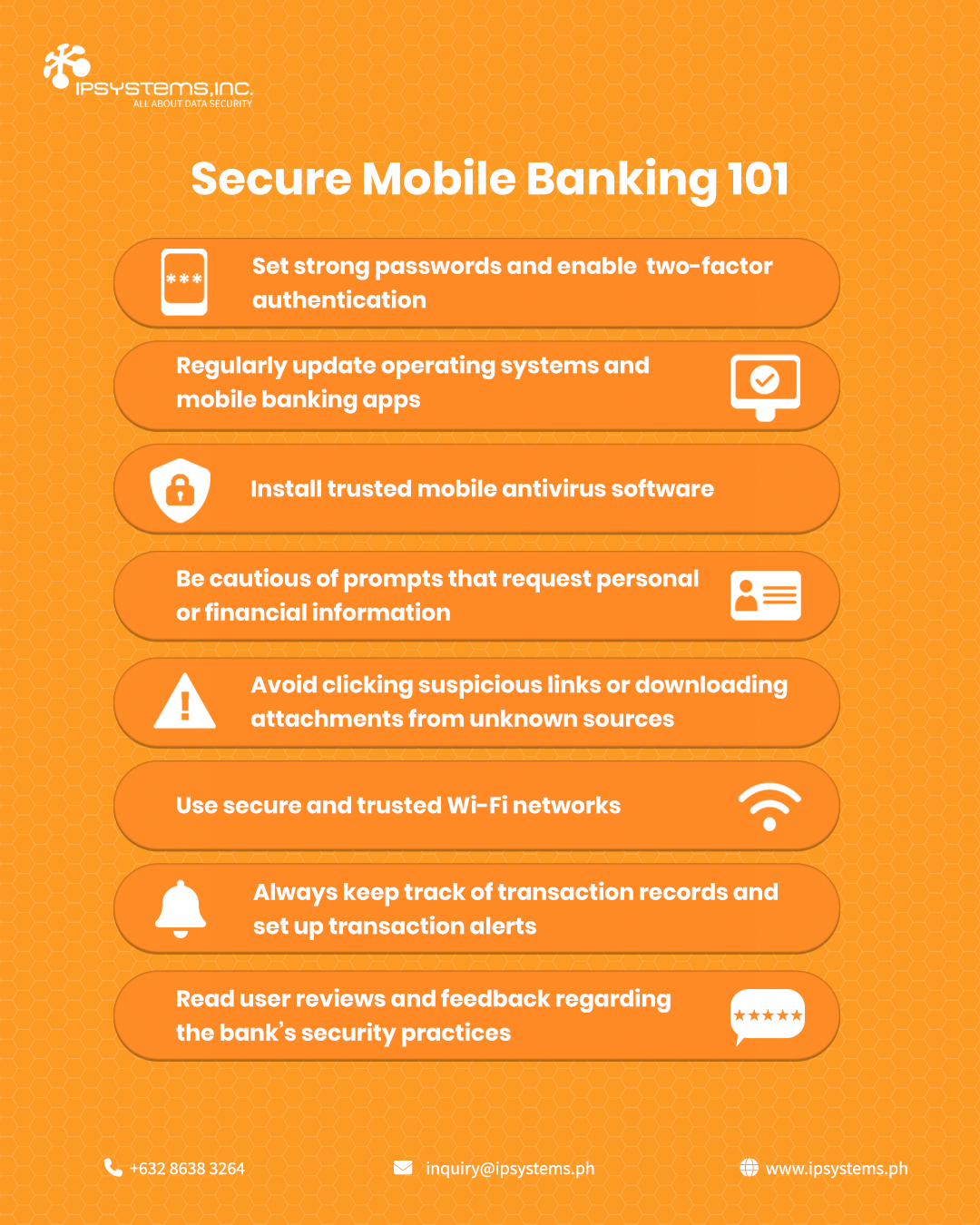

Here are a few essential tips to ensure a secure mobile banking experience:

A strong password is essential for protecting your online accounts. It should be a combination of uppercase and lowercase letters, numbers, and special characters to prevent unwanted access. Two-factor authentication (2FA) adds an extra layer of security by requiring a second verification step, such as a one-time code sent to your mobile device, or even biometrics such as a fingerprint scanner. This significantly reduces the chances of unauthorized access in case your password gets compromised.

Software updates often include security patches that address vulnerabilities discovered in previous versions. Keeping your operating system and mobile banking apps up to date ensures that you are protected against the latest threats and exploits, reducing the risk of data breaches.

Antivirus software helps protect your devices from malware, viruses, and other malicious software that could compromise your sensitive data. Choose a trusted and effective antivirus software that is regularly updated and compatible with your device.

Always be cautious and verify the legitimacy of personal or financial information requests before providing any detail. Cybercriminals may use phishing emails, fake websites, or fraudulent pop-ups to trick you into giving out your personal information.

Hackers most commonly gain access to your device by sending malicious links and attachments. Always be careful when clicking on links attached to emails, social media messages, or websites, especially if they come from unknown sources. Suspicious links often contain misspelled URLs, pure numbers, hyphens or symbols, and has unexpected link redirects.

Avoid using public or unsecured Wi-Fi networks when conducting financial transactions online. Hackers can potentially intercept data on these networks, so it's always safer to connect to password-protected and encrypted Wi-Fi networks or use your own mobile network.

Regularly review and monitor your transaction records and set up alerts for any unusual activity to detect potential fraud. Most banks offer transaction alerts via email or text messages, which can notify you of any significant changes in your account, providing you an early warning system.

There are a lot of banks and financial institutions you can choose from. But before you do so, always research and read reviews about their security measures and customer experiences first. Select a bank with a strong reputation for security, has positive reviews, and invests in cybersecurity and safeguarding its customers' data.

Despite the recent setback faced by GCash and the concerns surrounding the security of mobile banking, the demand for cashless transactions continue to grow due to its convenience and accessibility. However, users must remain vigilant and adopt essential security practices to avoid data and financial losses. By fortifying mobile device security, staying alert to cyberthreats, and practicing safe mobile banking habits, you can continuously enjoy the benefits of cashless transactions. With the right security measures in place, you can confidently embrace the digital revolution and take control of your financial well-being.

For more information on cybersecurity, you may reach at [email protected] or call us at +632 86383264.

Blog: Innovating your Business with Green Data Centers Data centers are centralized facilities equipped with essential hardware like servers, storage devices, and networking equipment.

Blog: CCTVs: A must-have for every organization Nearly every business and organization, regardless of size, has already implemented CCTV Services within their premises because

Blog: Combating Bullying in Digital Classrooms: Empowering Students for a Safer Learning Environment Bullying is a pervasive issue that inflicts emotional, psychological, and physical